- Strictly Macro

- Posts

- FOOD FOR THOUGHT - Reflexivity

FOOD FOR THOUGHT - Reflexivity

Reflexivity, Employment, Powell, Volcker & the Crypto Crash

Read Time: 8 mins

TABLE OF CONTENTS

MARKET CAP & REFLEXIVITY

JOBS AND REFLEXIVITY

WHAT ABOUT THE FED

CRYPTO CRASH

“I contend that financial markets are always wrong in the sense that they operate with a prevailing bias, but the bias can actually validate itself by influencing not only market prices but also the so-called fundamentals that market prices are supposed to reflect. That is the point that people steeped in the prevailing paradigm have such difficulty grasping. Beyond a certain point the self-validating feedback loops become unsustainable, That is how reflexivity gives rise to initially self-fulfilling but eventually self-defeating prophesies and processes. The most spectacular manifestation is in the boom/bust sequences that are characteristic of financial markets.”

I chose the Soros quote as ironically he is the only one who outbid Sam Bankam-Fried of FTX in terms of donations to the Dems for the midterms.Also, the book from which it is taken, "The Alchemy of Finance" has a forward by Paul Volcker. Ominous?

Source: Unusual Whales

Anyway, back to the quote.

As I look ahead at Q1 of 2023, I think we are about to enter the reflexive part of the cycle, where the dominos start to fall upon each other accelerating the downward spiral in both financial markets and the economy.

If you look at the market as cyclical (as opposed to linear) then I would say we are probably at the inflection point, where the speed of deterioration accelerates, before we eventually reach a trough.

MARKET CAP & REFLEXIVITY

After barely mentioning crypto for many weeks, last Sunday I issued an urgent warning on FTXs solvency and urged caution.

4 days later and BTC dropped -25%, ETH -35%, and FTX's very own shitcoin FTT is down -90%.

In the last 4 days, $200B dollars of crypto market cap has evaporated.Since the crypto peak exactly 1 year ago, on Nov 10th 2021 (happy anniversary!), $2T in value have been wiped off the face of the earth.

Why does this matter?

The simplest way of putting it is the reverse wealth effect.

When you are in the throws of a bull market and the value of your crypto is rising 10% a day, you feel rich, you buy Lambos, you go on holiday, you go out for expensive meals, you go shopping on Bond Street.

When your portfolio is down -75% in 12 months you become more thrifty.And this is not relegated to crypto alone.

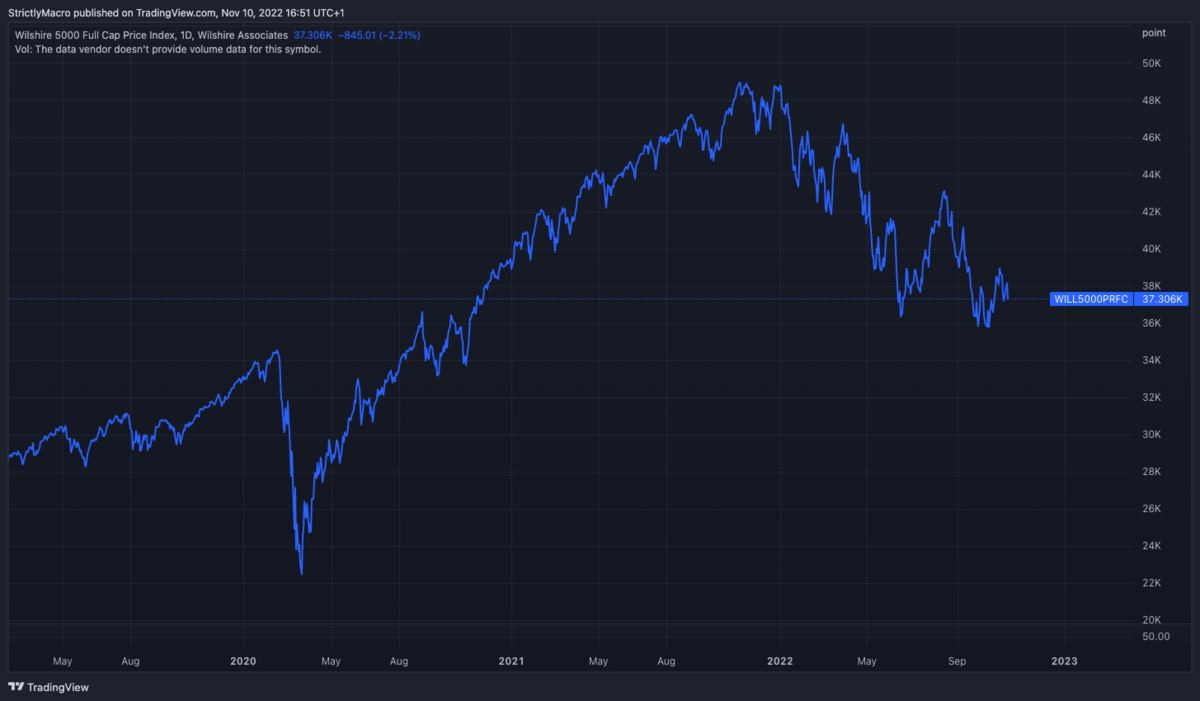

Willshire 5000 has lost $10T in value

MSCI World Market Index which captures large, mid, small and micro-cap representation across 23 Developed Markets has lost 24T dollars in value.

Source: Katusa Research

And how much has been wiped out in the Global Bond market?

If I had access to a Bloomberg terminal I could give you a more precise figure, but roughly we can estimate that in the last 12 months north of 30T dollars of global wealth has been destroyed.

Now you can play the cynic and say that that was fictitious wealth in the first place, and I would agree, but that is beside the point.

At the peak of the bull market you could take an NFT Ape (see image below), value it at over $1M and use it as collateral to take out a loan.

Source: BAYC

You could do the same with BTC (I did), equity (many CEOs did) and Bonds (pension funds did).

You used your assets to generate cash and then spent that cash, either in the real economy or to buy more assets.

This is the self-fulling part of the prophecy, where higher prices give rise to higher prices and the merry go round goes faster and faster.

But eventually, it has to slow and come to a stop, a few smart people get off, but many stay on for the next ride, the problem is the next ride spins in reverse, but momentum follows the same pattern of acceleration before deceleration.

Capital markets do not exist in a vacuum, they are a real-world thing, and in many countries a big part of people's assets and savings.

The declines we have seen in the last 12 months mean, just to pick one example, fewer CEOs buying yachts, which means fewer orders from suppliers, which means fewer jobs, which means less demand, which means economic pain for many and in some cases forced selling of assets, etc, etc.

JOBS AND REFLEXIVITY

META firing 12,000 employees this week, while it may be a positive for the stock in the short term, is certainly not good for economic growth over the next twelve months.And they are not alone, many similar companies are also either laying off or freezing hiring.

The layoffs are not relegated to tech alone, they are now starting to happen in housing as well. Redfin announced its laying off 13% of staff and shutting down its home-flipping business.

META has offered 16 weeks of severance pay ending in Q1 2023, Snapchat spent north of $100M in its last quarter on severance alone.These severance packages mean that many of those recently laid off are unlikely to register as unemployed or seek unemployment benefits until early next year.

We are entering the phase where unemployment will start to tick up, but we won’t see the bulk of it show up in the numbers until the start of next year.Meanwhile, consumer spending will continue to trickle down, which is real bad for advertising, consumer discretionary, retail, auto etc.

Discretionary products were net beneficiaries of Covid, as people spent less on services and more on things.As this slams into reverse, there is going to be a huge decline in revenues, from companies that sell apparel to those that sell home improvement materials and furniture.We have already started to see it in earnings

Do you really want to own Tesla, Home Depot or RH heading into next year? And heck I would put Apple into that basket as well.Are you surprised that they have cut back on iPhone 14 orders?

The reflexive part of the economic downturn is about to begin.

Historically the largest declines in the market occur after the unemployment rate starts to tick up.

WHAT ABOUT THE FED

Now you are probably thinking, heck this is so bad, this is so obvious, why is the Fed not doing anything? do they want to make things even worse?

Let me ask you another question instead, what if Powell doesn't care about the stock market? What if he has taken it upon himself to right the excess' caused by easy money over the last 30 years?

Powell is not Greenspan, Bernanke or Yellen, he has always been more critical and cognisant of the risks and consequences of low rates and QE, but due to the situations he was faced with, he was forced to continue along the same path as his predecessors.

It appears inflation is the excuse he needed to break with 30 years of modern economic dogma and instead he may be trying to restore the balance between labour and capital which for thirty years has been trending away from main street and towards wall street?

If you think this odd, then why has Powell stated several times this year that he idolises Volcker and that the Fed should take inspiration from his resolve and actions?

If you want to learn more about this topic I wrote an article specifically on the consequences of 0% interest just a month ago.

But hey, this is all inferred and guesswork, I don't know Powell, all I know is that for now, inflation is too high (even at 7.7%) by the Feds standards and the employment picture on the surface is still strong, so unless anything systemic happens, it appears that a decline in asset prices alone is not going to be enough to reverse Fed policy and turn the spigots of helicopter money on again.

In fact, the Fed seems to specifically want to engineer the reverse wealth effect we discussed at the start, so higher market may actually mean higher rates.

CRYPTO CRASH

All Bitcoin models are now broken.

Stock to flow is dead.

Source: Plan B

The idea that BTC never falls below its prior cycle high is in the process of being disproven.

Bitcoin has barely 10 years of history and all during a secular bull market where monetary policy was accommodative and liquidity abundant.

BTC has never been through the trough part of the cycle, or prolonged tightening.Are you going to lay credence to Bitcoin models with less than 10 years worth of data?

Many are speculating the bottom is at 16K, then they will say it is at 12k, then 10k then 8k.

I am not a big fan of giving price targets, but let me put things in this context: After bubbles, the S&P on average has declined around -50% I see no reason to assume the S&P will not do the same this time.

So if the S&P declines -50%, that brings it back to the Covid lows.If S&P is back at covid lows where is BTC?4K

I URGE CAUTION

Many bottoms will be called based on technical levels, or other thingsbut in the end it is all about When not Where.There is no magic level.

Haw many crypto companies are linked to Alameda and FTX?A lot.

Blockfi has already faced liquidity issues, these are likely to re-emerge now that Alameda who supposedly backstopped Blockfi is going under.

Coinshares has exposure to FTX and funds locked on the exchange.

And crypto.com, Nexo? they are not exposed to FTX, but they have already faced issues of their own.The more prices decline the more hidden risk will emerge.The solvency of Silvergate (SI) who has issued BTC backed loans is already being called into question.

And the miners? They will become forced sellers as high energy costs and low prices impact their margins. Many of these expanded hugely during the boom by taking on enormous amounts of debt.Will they be able to pay it back?RIOT MARA

Source: CryptoQuant

And what about Tether?USDT is the largest stablecoin in the world, and their redemption are rising fast. Market cap has shrunk from $83B to $68B

Source: CoinMarketCap

Tether price wobbled today, before it was rescued.

Source: CoinMarketCap

At the end of the day it is all a matter of trust.If trust fails, Tether faces a bank run, just like FTX did, and in that moment they may not have the necessary liquidity.

Personally, I think the situation is very very different from 2018 for crypto.This time tokens are actually going to zeroLUNA, UST, FTT, CRO etc…

Most will not come back, Bitcoin may.

Ironically the system getting washed of fraud and scammers and Wall Street may good for BTC. Bitcoin is also a speculative asset, but out of all of them, it actually makes some sense, so I am not going to rule it out completely.

BTC.inc must die for BTC OG to thrive.

I don't think Bitcoin is the future of money as is often purported for a very simple reason: centuries of history show that humans over time have moved towards a more elastic form of money.Bitcoin does not meet this basic requirement.

It may however have a role to play as a digital form of Gold, and that alone is no small role in terms of potential market cap size.

But we shall have to see, in the meantime,

I URGE CAUTION

Thank you for reading,Antonio

P.S.

I will have more thoughts to share on todays squeeze, and where I think we are going from here, in Sundays note.But remember, starting this weekend this will be available to Premium Members only.A lot of work goes into these articles and I cannot continue to do this for free, particularly if I want to scale this operation and improve the data and quality of content I share with you.

If you find value in these articles and want to keep on reading them please follow the link bellow

I am not a Financial Advisor & this is not financial adviceNone of the information or content shared via the Strictly Macro Newsletter constitutes investment, trading or other advice, nor an endorsement or recommendation of any financial instrument whatsoever. Investing and trading of any kind involves risk with no guarantee of return. This newsletter is for general information purposes only and is not tailored to any individuals’ personal needs or risk parameters. Reference to a security’s past performance should not be construed as guarantee of future returns. Unless otherwise stated all views are those of the author at the time of writing and can be subject to change without notice. Reasonable care has been taken to ensure that all information provided is true and reliable, however Strictly Macro does not assume responsibility for any error or omission. None of the authors of this newsletter are registered as securities broker-dealers or investment advisors either with the FCA, the SEC, CFTC or with any other regulatory authority. Do your own research and seek professional consultation before making any investment decision.